Figure AI's $39.5 Billion Valuation: An In-Depth Analysis

Figure AI's $39.5 Billion Valuation: A Comprehensive Analysis of Silicon Valley's Latest Robot Phenomenon

The Bold Valuation and What Drives It

Figure AI, a three-year-old robotics startup with minimal current revenue, is seeking to raise approximately $1.5 billion at a proposed valuation of $39.5 billion. If completed, this round would place the company above several long-established industrial firms by market value, despite its early stage of commercial deployment.

Invest in top private AI companies before IPO, via a Swiss platform:

The valuation is based primarily on forward-looking projections. According to materials shared with prospective investors, Figure AI aims to deploy more than 200,000 humanoid robots across industrial and domestic environments by 2029, with internal forecasts suggesting annual revenue could reach approximately $9 billion by that time. These projections imply a rapid transition from prototype-level deployments to large-scale commercialization within a relatively short time frame.

The fundraising structure reflects current private-market dynamics. Alongside large institutional investors, intermediaries such as Align Ventures are assembling special-purpose vehicles (SPVs) to pool capital from smaller participants. This approach broadens access to the round while reducing concentration risk for lead investors. At the same time, secondary-market solicitations have circulated widely, positioning Figure AI shares as a high-demand private asset.

The Remarkable Valuation Journey and Market Dynamics

The pace of Figure AI’s valuation increase has been notable. In February 2024, the company raised $675 million at a $2.6 billion valuation, with participation from Microsoft, Nvidia, OpenAI, and Jeff Bezos’s investment firm. The current fundraising effort implies an increase of more than fifteen times in valuation within a single year.

This increase has not been accompanied by a proportional rise in revenue or completed robot deployments. Instead, it reflects investor expectations around long-term humanoid robotics adoption and Figure AI’s claim that it has developed an internally built, end-to-end robot AI system following the conclusion of its collaboration with OpenAI.

Investor interest appears to be driven largely by narrative momentum: the combination of high-profile backers, ambitious deployment targets, and early industrial pilots. Public communications from the company emphasize progress toward real-world use cases, positioning Figure AI alongside other long-term robotics initiatives such as Tesla’s Optimus program.

Brett Adcock: The Serial Entrepreneur Behind the Vision

Figure AI was founded in 2022 by Brett Adcock, an entrepreneur with prior experience scaling companies in emerging technology sectors. Adcock previously co-founded Vettery, an online recruiting platform acquired in 2018, and later Archer Aviation, an electric vertical-takeoff aircraft company that went public via a SPAC transaction in 2021.

After departing Archer in 2022, Adcock launched Figure AI, raising early venture funding and unveiling the company’s first humanoid robot prototype in 2023. His background has helped attract investor interest, particularly among those willing to back founders pursuing technically ambitious, long-duration projects before clear commercialization pathways are established.

The BMW Partnership: Real-World Testing Ground

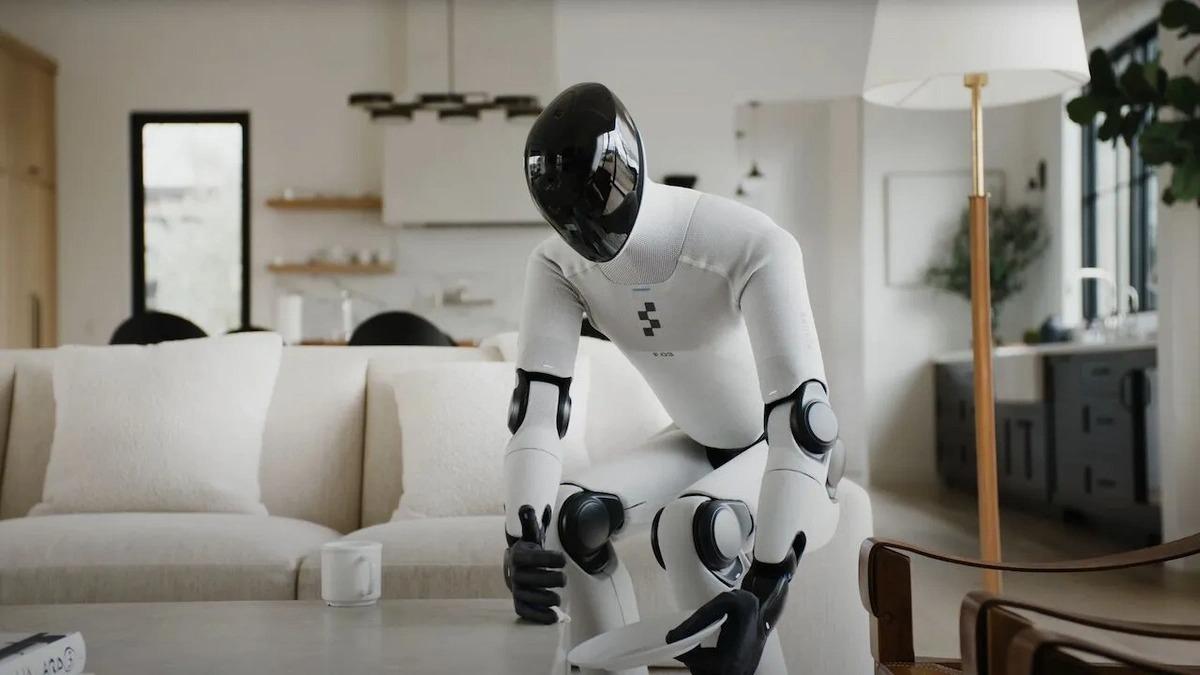

Figure AI’s partnership with BMW represents its most visible industrial deployment to date. The company shipped humanoid robots to BMW’s manufacturing facility in South Carolina, initially for evaluation during non-production periods. Early confirmations indicated that three robots were present on site, with one operating at a time to practice basic material-handling tasks.

Subsequent updates from BMW indicated that additional robots were introduced and that limited interaction with live production workflows had begun. While this marks a step beyond laboratory demonstrations, BMW has described the initiative as an evaluation phase rather than full operational integration.

Public videos released by Figure AI show robots moving components and performing defined tasks. However, these activities remain controlled and do not yet reflect the speed, reliability, or autonomy required for continuous high-volume manufacturing environments.

Investment Frenzy and Market Mechanisms

Figure AI’s fundraising illustrates how private-market momentum is increasingly shaped by marketing, social media visibility, and secondary trading activity. The company’s progress updates are frequently shared through public channels, contributing to heightened interest ahead of traditional financial disclosures.

Secondary share offerings and SPV participation have further amplified demand, allowing investors to gain exposure without direct access to primary allocations. In several cases, these vehicles target tens of millions of dollars to purchase shares at the proposed valuation, reinforcing price expectations before audited results are available.

The Reality Behind the Promises

Despite the strong interest, there remains a significant gap between Figure AI’s long-term projections and its current operating metrics. The company reported no meaningful revenue in recent periods and has deployed only a limited number of robots in pilot environments.

Investor materials emphasize future scale rather than present performance, and detailed audited financial statements have not been widely disclosed. The BMW partnership demonstrates technical progress, but it also highlights the early and experimental nature of current deployments.

This dynamic does not suggest misrepresentation, but it reflects a broader trend in advanced AI and robotics investing: valuations increasingly price in anticipated breakthroughs years before commercial proof is established.