AI Investment Strategy and Modern Portfolio Construction

AI Investment Strategy and Modern Portfolio Construction: A Comprehensive Guide

AI Investing Strategy: Where the Real Action Is

Artificial intelligence represents far more than just another "hot sector" – it has become the new backbone of modern investment portfolios. Rather than treating AI as one vague, monolithic theme, successful investors break this opportunity into three distinct, investable pillars: core AI models, computing infrastructure, and humanoid robots. Together, these areas form a powerful ecosystem where capital is already flowing and revenues are growing at an unprecedented pace in financial markets.

Invest in top private AI companies before IPO, via a Swiss platform:

Core AI Models: The Brains of the Revolution

The first pillar encompasses companies building the fundamental AI models – the "brains" that power chatbots, copilots, and advanced automation systems. Investors who backed companies like OpenAI early have already witnessed extraordinary returns. OpenAI has grown to approximately $13 billion in annual revenue with a valuation approaching half a trillion dollars in just two years. Anthropic, another leading AI laboratory, expanded its revenues from $1 billion to $5 billion in merely eight months.

These are not fragile startups chasing temporary hype. They already maintain large, paying customer bases, solid cash flows, and rapid expansion trajectories. For investors, this demonstrates that AI models represent current business engines generating substantial returns, not distant promises about future possibilities.

Computing Infrastructure: The Foundation of AI Growth

Computing infrastructure represents the most predictable and defensive component of the AI megatrend. Every AI model, regardless of its creator, requires enormous computing power. This power derives from specialized chips (GPUs) and the data centers, networking systems, and platforms that connect and manage them.

The logic remains straightforward: even if uncertainty exists about which AI model will dominate in five or ten years, all of them will demand increasing computational resources. This makes infrastructure the "picks and shovels" of the AI revolution. Databricks has crossed $3 billion in annual revenue while maintaining exceptional growth rates. Nvidia continues seeing data-center revenue increases of 60 to over 150 percent. SpaceX is developing plans to utilize Starlink satellites for space-based computing infrastructure supporting AI applications.

This segment must grow faster than the AI models themselves, because every breakthrough in AI increases demand for computing power. For investors, this creates long-term, structural demand rather than cyclical fashion trends.

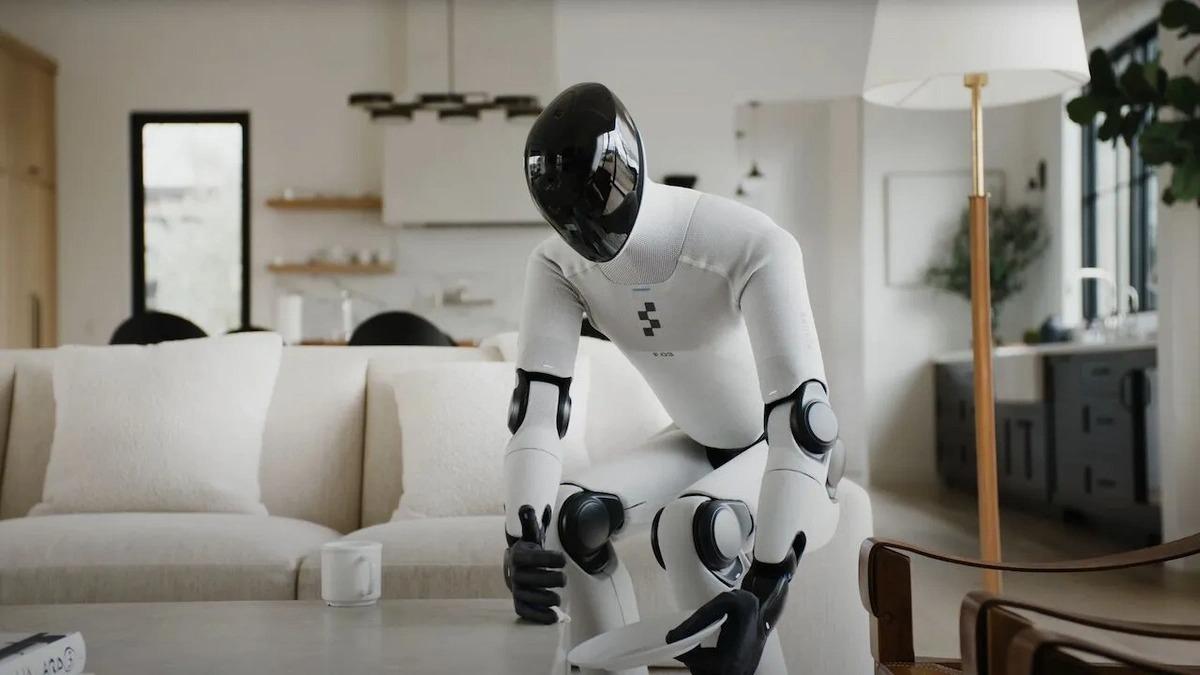

Humanoid Robots: AI Enters the Physical World

The third pillar may sound futuristic, but humanoid robots are rapidly becoming commercial reality. Previously, AI existed primarily in software: screens, applications, and cloud services. Humanoid robots mark the transition when AI begins performing physical work in factories, warehouses, and eventually residential environments.

Real-world deployments are already operational. Figure AI collaborates with BMW on robots in U.S. manufacturing facilities. Agility Robotics operates machines in Amazon warehouses. These represent actual commercial deployments, not laboratory demonstrations. Valuations reflect this momentum: Figure AI surged from $2.6 billion to $39 billion in approximately eighteen months – a fifteen-fold increase. Tesla develops its humanoid project Optimus, while a wave of affordable, home-oriented robots emerges.

For investors, this represents the next stage of AI evolution: transitioning from algorithms that process information to machines performing real-world tasks. As physical labor automation expands, investment potential increasingly shifts toward this segment.

Risk Assessment: Understanding the Hidden Fault Lines

While AI may drive this decade's growth, it operates across a landscape filled with potential challenges. The most sophisticated investors recognize these risks: regulation, geopolitics, competition, valuations, and infrastructure constraints including energy supply.

Regulatory Challenges

Regulation represents the most immediate threat to AI momentum. Governments continue determining how to control this technology, and each new regulation can slow model development pace. Strong AI companies can be forced to reduce speed if policymakers decide technology advancement is too rapid. This regulatory uncertainty creates investment volatility that extends beyond company performance.

Geopolitical Competition

Artificial intelligence has become part of a global technology arms race. The United States, Europe, and China compete not just commercially but strategically. Political decisions ripple through AI valuations as nations prioritize technological independence and security. AI investments now depend not only on technology success but also on stable international relations.

Competitive Dynamics

Competition risk is expanding rapidly. No longer limited to a few major technology players, numerous companies now build proprietary AI models and infrastructure. This changing landscape means competitive moats around current AI leaders may be less durable than they appear. In an environment where many organizations train their own models, market dominance cannot be guaranteed.

Valuation and Energy Constraints

Many AI companies are priced for sustained perfection, with valuations assuming very high revenue growth for extended periods. Additionally, AI represents both a software and energy challenge. Training and operating advanced models consumes enormous electricity quantities. If energy infrastructure fails to keep pace, AI growth itself can stall. Future gains depend not only on algorithm improvements but also on power generation and transmission capacity.

Evidence Against the Speculation Bubble Theory

Contrary to dot-com era comparisons, AI demonstrates characteristics of a revenue-generating sector with substantial customers and products already reshaping entire industries. Leading AI players generate billions in revenue: OpenAI approaches $13 billion annually, Anthropic expanded from $1 billion to $5 billion in eight months, and these represent profitable, cash-generating companies with large corporate clients.

The infrastructure layer appears particularly solid for investors. Every advanced AI model requires massive computing power from specialized GPUs. This creates structural, long-term demand regardless of which specific AI model succeeds. Everyone requires the same foundation: computing power and data infrastructure.

Real-world applications demonstrate measurable value creation. AlphaFold solved a 50-year-old scientific challenge in protein structure prediction, earning the Nobel Prize in Chemistry in 2024. DeepMind's systems reduced Google's data-center energy usage by 40 percent, generating billions in savings. These examples show AI already visible on profit-and-loss statements as increased revenue and reduced costs.

Modern Portfolio Construction Principles

Successful portfolio construction abandons the "buy one thing and hold forever" approach in favor of sophisticated diversification across asset classes. Professional institutions build portfolios around intelligent combinations of different assets, each serving specific roles rather than relying on single trends or sectors.

The fundamental principle holds that no single asset should simultaneously provide both growth and safety. These functions are distributed across different portfolio components, exactly how professional portfolios are engineered. Even powerful themes like AI serve as growth engines within larger structures, not complete investment vehicles.

Asset Class Diversification

Effective portfolios distribute investments across distinct categories: growth assets including AI companies and technology firms, stabilizing elements like government bonds and precious metals, real estate for inflation protection and steady income, and alternative investments for additional diversification. Each asset class performs specific jobs, but none should dominate the entire portfolio.

Time horizon significantly influences portfolio composition. Long-term goals (ten-year planning) allow larger allocations to growth assets including AI companies and high-potential equities, with smaller stabilizing elements. Medium-term horizons (five years) require more balanced approaches where stocks remain important but bonds and real estate comprise roughly half the structure to withstand market volatility.

Professional diversification focuses on owning different types of assets that behave differently under various market conditions, rather than simply owning many similar investments. This systematic, balanced approach consistently outperforms emotional, concentrated strategies that individual investors often employ.

Common Retail Investment Mistakes

Individual investors often behave very differently from major financial institutions, creating expensive gaps in their investment outcomes. Four recurring problems dominate: excessive real estate concentration, speculative cryptocurrency investments, emotional decision-making, and lack of coherent strategy.

Many investors treat real estate as their primary investment vehicle because property feels solid and visible. However, this comfort becomes problematic when real estate dominates entire portfolios. Professional institutions use real estate as one stabilizing component, not the complete strategy. Concentration in single asset classes creates liquidity constraints and often produces returns that lag diversified approaches.

Cryptocurrency speculation represents another common error, where investors confuse underlying blockchain technology with speculative tokens. While blockchain technology solves real business problems and creates measurable value, cryptocurrencies often rise and fall based on sentiment and trend-following rather than fundamental economic value.

Emotional decision-making leads to classic investment traps: purchasing assets when they become fashionable and expensive, panic selling during market declines, and constantly chasing current news trends. This contrasts sharply with institutional approaches based on systematic processes, research, and long-term thinking.

Perhaps most significantly, many individuals approach investing as a search for "magic answers" – single stocks or "sure things" that will solve all financial challenges. Successful investing requires treating wealth management like healthcare: no single solution addresses complex, long-term needs. Professional approaches rely on experience across multiple market cycles rather than trends or temporary opportunities.

Integration and Implementation

Smart money never concentrates everything in single themes – not real estate, not cryptocurrency, not even AI despite its enormous potential. Instead, sophisticated investors build portfolios where each component serves specific functions: AI and growth sectors drive returns, stocks capture global economic expansion, bonds and precious metals provide stability, and real estate serves as one of several anchoring elements.

This systematic, balanced methodology consistently outperforms emotional, concentrated, trend-following strategies that many individual investors still utilize. The key lies in understanding that modern portfolio construction creates balanced ecosystems of asset classes rather than monuments to individual ideas. When growth engines like AI operate within frameworks including stocks, bonds, real estate, precious metals, and alternatives, the result captures major technological shifts without vulnerability to sudden market shocks.

The evidence suggests that AI represents a fundamental shift in how business operates, backed by real revenues, paying customers, and measurable productivity improvements. However, successful AI investing requires embedding these opportunities within diversified, professionally structured portfolios designed to perform across different market conditions and time horizons. This approach allows investors to participate in technological transformation while maintaining the stability and risk management that preserve wealth over extended periods.