Breaking the Mold: How Diverse Founders Are Redefining Success in Venture Capital

Breaking the Mold: How Diverse Founders Are Redefining Success in Venture Capital

Introduction: Challenging the Silicon Valley Stereotype

For decades, venture capitalists have operated under a narrow definition of what successful entrepreneurs look like: typically white, male, elite-educated individuals who can deliver polished pitches in the conventional Silicon Valley style. This pattern matching approach has dominated investment decisions, creating significant barriers for founders from diverse backgrounds. However, groundbreaking research from Ada Ventures, conducted in collaboration with behavioral scientists at Synaptiq, is fundamentally challenging these long-held assumptions with compelling empirical data.

The comprehensive study analyzed 171 unicorn founders across the UK, Europe, and North America, with particular focus on 88 founders from diverse backgrounds including women, ethnic minorities, LGBTQ+ individuals, and those from lower-income communities. The results are nothing short of revolutionary: diverse and non-diverse founders share nearly identical psychological traits across 159 measured characteristics, suggesting that success is far more about measurable qualities than demographic background.

The Remarkable Similarity of Unicorn Founders

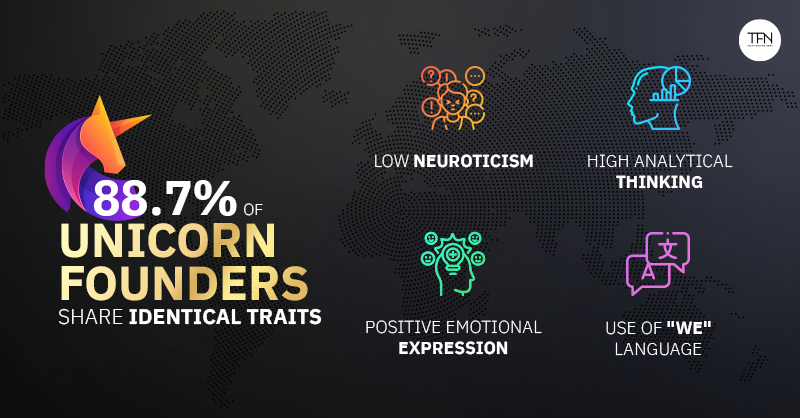

The study's most striking finding reveals that unicorn founders, regardless of their background, share an astounding 88.7% of psychological traits. Out of 159 characteristics examined, only 18 showed meaningful differences between diverse and traditional founders. This data fundamentally undermines the notion that successful entrepreneurs must fit a particular demographic profile.

Common traits among all successful founders included exceptional ability to remain calm under pressure, strong analytical thinking capabilities, positive emotional expression, and inclusive leadership styles characterized by frequent use of "we" language. These shared characteristics span cognitive abilities, emotional intelligence, communication patterns, and leadership approaches, creating a comprehensive profile of entrepreneurial success that transcends traditional demographic categories.

Interestingly, when differences did emerge between diverse and traditional founders, they often favored those from underrepresented backgrounds. Diverse founders demonstrated 23% more empathetic language usage, reflecting stronger team-building capabilities and emotional intelligence. They exhibited 20% greater focus on present-moment awareness, a trait strongly associated with charismatic leadership and decision-making under uncertainty. Additionally, diverse founders were 21% less tentative in their communication, displaying higher levels of confidence and conviction in their vision and strategy.

The Persistent Funding Gap: Numbers Don't Lie

Despite these demonstrated strengths and shared success traits, funding disparities remain stark and troubling. In the UK, female founders secure merely 3% of seed funding compared to 84% received by male founders. The situation is even more dire for ethnic minorities, who receive just 1.58% of venture capital funding. Black women founders face the most extreme disparity, securing only 0.02% of total investment over the past decade. Similar patterns persist across North America, where white male founders, representing 30% of the population, account for 58% of venture investors and capture 93% of venture funding.

This funding gap persists primarily due to pattern matching behavior among venture capitalists, where investors unconsciously favor founders who resemble previous successful investments. This approach creates a self-perpetuating cycle that excludes diverse talent despite clear evidence of their potential for success. The reliance on familiar profiles limits the industry's ability to identify and support the next generation of innovative leaders.

The Inclusive Alpha Model: A Revolutionary Approach

Ada Ventures is actively disrupting this pattern through their innovative Inclusive Alpha model, which combines sophisticated psycholinguistic analysis with comprehensive support systems for diverse founders. This approach moves beyond surface-level demographics to identify the psychological traits that actually predict entrepreneurial success, while simultaneously addressing systemic barriers that diverse founders face.

The Inclusive Alpha model provides tangible support including childcare assistance, mental health resources, specialized pitch coaching, and tailored mentorship programs. These support systems address real-world challenges that often disproportionately affect underrepresented founders, leveling the playing field and enabling talent to flourish regardless of background.

The results speak for themselves: 54% of Ada Ventures' portfolio companies are led by women, nearly double the industry average of 28%. Furthermore, 88% of their Fund II founders come from underrepresented groups, demonstrating that intentional inclusive practices can dramatically shift investment patterns without compromising returns.

Reframing Diversity as Competitive Advantage

Check Warner, co-founding partner at Ada Ventures, emphasizes a crucial perspective shift: "Diversity is not just a nice-to-have or social responsibility initiative. It represents a commercially credible strategy that identifies talent from all backgrounds. Every investor seeks alpha returns, yet diversity is often treated as optional rather than essential. The data tells a different story—traits that drive success don't come in a single package."

The research suggests that the minor differences favoring diverse founders actually represent genuine competitive advantages. Enhanced empathy and communication skills translate into stronger team dynamics, better customer understanding, and more effective stakeholder management. Improved present-moment focus contributes to superior decision-making under pressure and more authentic leadership presence. Higher confidence levels help diverse founders navigate systemic biases and persist through challenges that might derail less resilient entrepreneurs.

The Path Forward: Implications for Venture Capital

This paradigm-shifting research calls for fundamental changes in how venture capitalists evaluate entrepreneurial potential. With nearly 89% of success-driving traits shared across all backgrounds, continuing to rely on outdated founder profiles means systematically missing promising investment opportunities and limiting innovation potential.

Progressive investors are beginning to adopt psycholinguistic tools and data-driven assessment methods that identify proven success traits regardless of demographic background. These approaches offer more accurate prediction of entrepreneurial success while expanding the talent pool to include previously overlooked founders who possess the same essential qualities as traditional unicorn creators.

The implications extend beyond individual investment decisions to industry-wide transformation. As diverse founders continue to demonstrate equivalent success traits while bringing additional advantages like enhanced empathy and communication skills, the venture capital industry faces a choice: adapt evaluation criteria to capture this broader talent pool or risk missing the next wave of transformative companies.

Conclusion: The Future of Entrepreneurial Success

The evidence is clear: successful entrepreneurs share fundamental psychological traits that transcend demographic boundaries. The next world-changing unicorn may not fit the traditional Silicon Valley mold, but they will possess the same determination, analytical thinking, leadership capabilities, and resilience that characterize all great founders.

As the entrepreneurial landscape evolves, the question becomes whether venture capital will adapt quickly enough to identify and nurture these hidden gems. The tools and data now exist to make more informed, inclusive investment decisions that can unlock previously untapped innovation potential.

The future belongs to investors who recognize that talent is evenly distributed across all communities, even if opportunity has not been. By embracing inclusive approaches that identify success traits rather than familiar patterns, the venture capital industry can simultaneously drive better returns while fostering a more equitable and innovative entrepreneurial ecosystem.