Venture Capital Market Analysis 2025

The 2025 Venture Capital Landscape: AI Dominance and Market Concentration

Venture Funding Rebounds with Dramatic Market Shifts

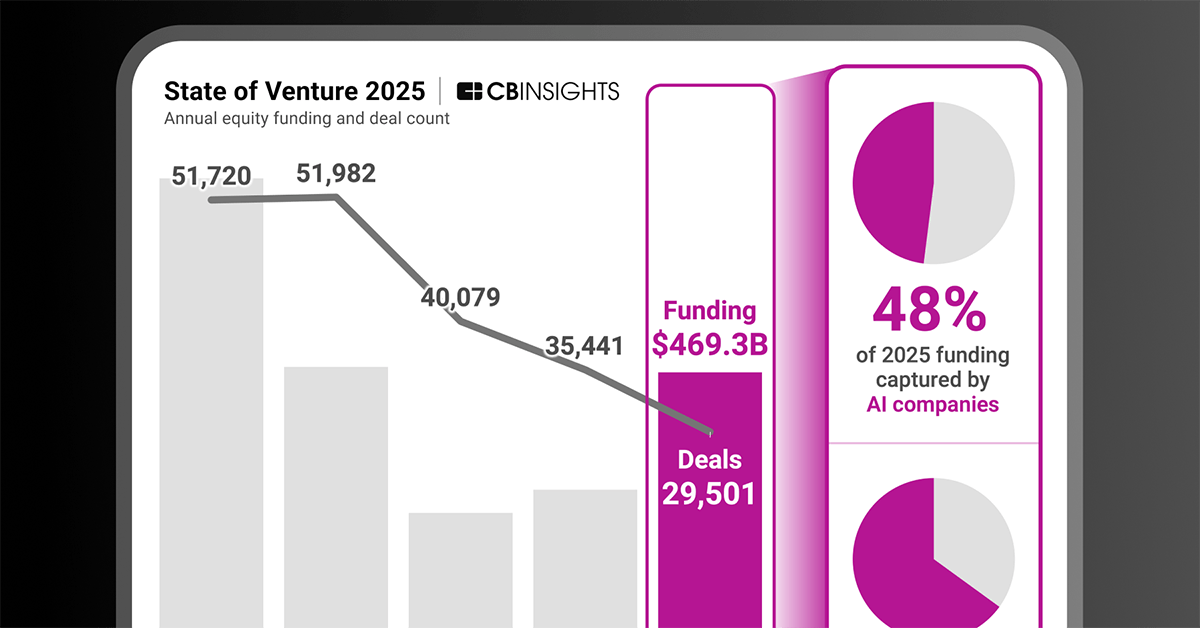

The venture capital market in 2025 presents a striking paradox: while total funding surged dramatically, the distribution of capital has fundamentally transformed. Global venture funding reached $469 billion, representing an impressive 47% year-over-year increase. The final quarter alone attracted $152 billion, marking the most active funding period since early 2022.

Invest in top private AI companies before IPO, via a Swiss platform:

However, beneath this headline growth lies a dramatic shift in investment strategy. The total number of deals dropped 17% to 29,501, while mega-rounds exploded by 77% to 738 deals, absorbing $307 billion or 65% of all venture funding. This trend reveals that investors are writing significantly larger checks to a much smaller group of companies, abandoning broad diversification in favor of concentrated bets on perceived category leaders.

Artificial Intelligence Captures Nearly Half of All Investment

Artificial intelligence has evolved from one sector among many to the dominant force in venture capital. In 2025, AI companies raised an extraordinary $226 billion, capturing 48% of all venture funding globally. This concentration represents a fundamental power shift, with nearly one out of every two venture dollars now flowing into AI-focused startups.

The six largest funding rounds of 2025 all went to AI companies, collectively raising $111 billion - nearly half of all AI funding and almost a quarter of total venture capital across all sectors. This includes industry giants building foundation models, AI applications, and supporting infrastructure. Most investors are treating AI as a once-in-a-generation platform shift, comparable to the rise of the internet or smartphones, but moving faster and at unprecedented scale.

Robotics and Physical AI Achieve Record Investment

Robotics companies experienced a breakout year, raising a record $40.7 billion and capturing 9% of all venture funding. This surge is powered by physical AI - intelligent systems that operate in the real world, combining software intelligence with mechanical capabilities. These systems are designed to see, decide, and act autonomously in factories, warehouses, construction sites, and various industrial applications.

Industrial humanoid robots led all robotics markets with 80 deals in 2025. However, the sector shows signs of speculative investment, with companies like Figure reaching a $39 billion valuation - a 15x increase in a single year - despite having zero revenue. Physical AI model developers have emerged as some of the most dynamic players, with robot foundation models becoming critical for enabling robots to perform reliable, narrow tasks in controlled environments.

Private Company Valuations Reach Historic Heights

The world's most valuable private companies achieved unprecedented valuations, with the top 10 firms crossing a combined worth of over $2 trillion. AI leaders dominate this landscape, with OpenAI reaching a $500 billion valuation and Anthropic hitting $350 billion. These figures place private AI companies in public-market mega-cap territory.

Non-AI giants also achieved substantial valuations, with ByteDance at $480 billion and SpaceX at $400 billion. However, valuation growth rates differ significantly between sectors. Anthropic increased its value 19x in one year, while OpenAI grew 218%. In contrast, established non-AI companies like SpaceX grew more steadily at 14%, reflecting different investor expectations for AI versus proven business models.

Elite Investors Concentrate on AI-Focused Strategies

The world's most successful venture capitalists have fundamentally shifted their investment approach. Among the 25 best-performing firms over the past decade, the top 10 targeted markets were exclusively AI-focused. This represents a dramatic departure from traditional venture diversification strategies, with elite investors clustering around high-conviction AI themes.

Key investment areas include AI-powered workplace productivity tools, generative AI application developers, multimodal AI systems, voice AI platforms, and large language model developers. This concentration reflects a belief that AI represents the new "operating system" for work and that a few dominant platforms will capture most of the value in this emerging ecosystem.

Market Implications and Future Outlook

The 2025 venture landscape reveals a market that is simultaneously booming and narrowing. More capital than ever is being deployed, but it flows into fewer deals, larger rounds, and a concentrated set of dominant markets and companies. The United States has emerged as the gravitational center of global venture capital, with concentrated funding patterns that can influence startup valuations worldwide.

This concentration brings both opportunities and risks. While investors may be correctly anticipating the transformative potential of AI and robotics, the heavy concentration in a small number of companies and themes creates systemic risk. Any significant disruption to the AI sector could ripple through the entire venture ecosystem, as there are insufficient fast-growing non-AI sectors to absorb displaced capital.

For the broader startup ecosystem, 2025 represents more than just a recovery year - it marks a fundamental reordering of venture capital around AI dominance, with power, capital, and risk increasingly concentrated at the very top of the market. This trend will likely continue to shape investment patterns, startup strategies, and innovation priorities in the coming years.