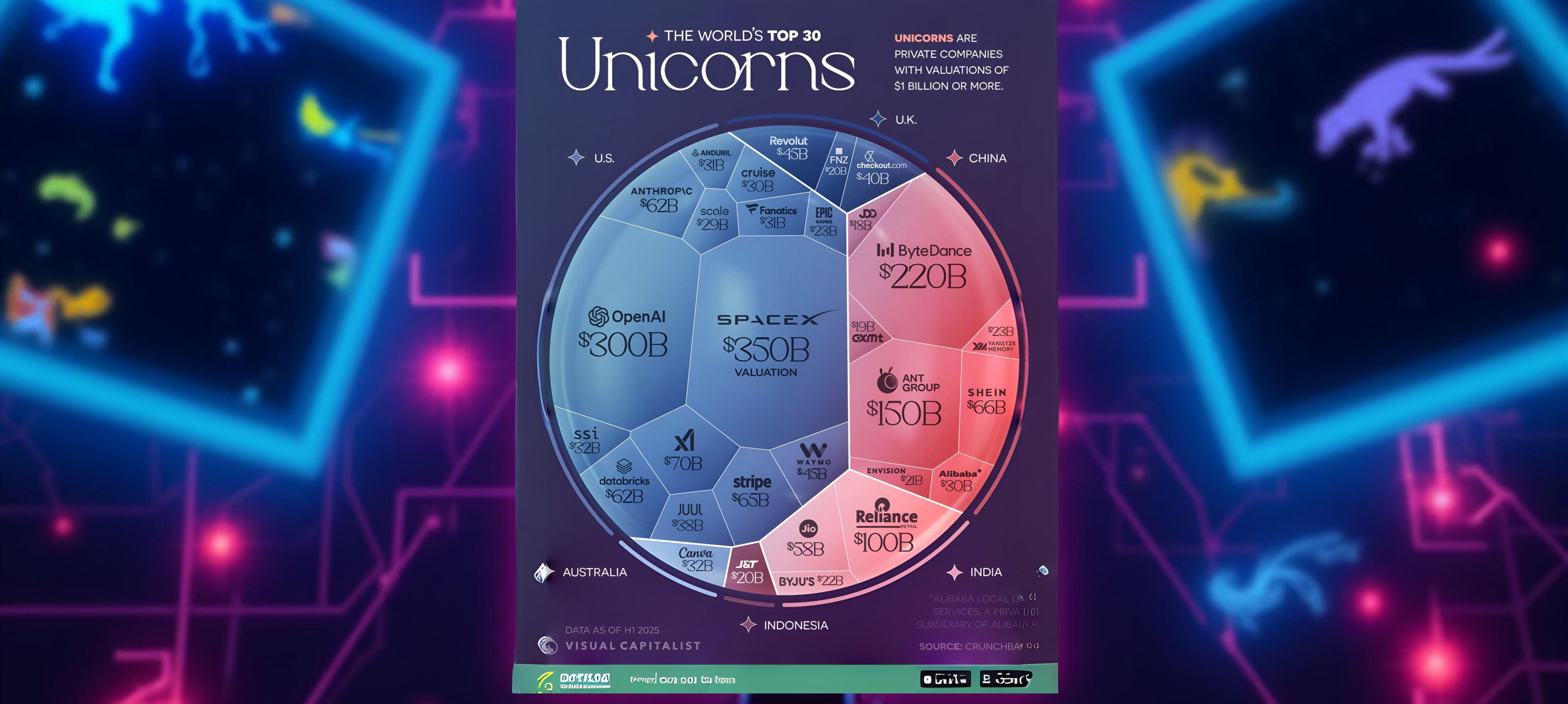

The World's Most Valuable Unicorn Companies in 2025

In an enthralling landscape where billion-dollar unicorns roam the economic savannah, these mythical companies are more than just creatures of value—they are blazing the trails of innovation and capturing investors' imaginations worldwide. The unicorn landscape is experiencing a remarkable resurgence in 2025, riding the wave of the generative AI boom and renewed investment flows that are reshaping the global technology sector.

SpaceX: The Revolutionary Leader

Imagine a company that's not just shooting for the stars but hitting them. SpaceX, founded by the visionary Elon Musk, sets the scene as the most valuable unicorn of 2025, with a staggering valuation of $350 billion. This isn't just a number; it's a testament to how SpaceX is reshaping the frontier of space travel and satellite communications, leaving competitors in cosmic dust.

It all boils down to partnerships and visionary projects. SpaceX's alliance with NASA isn't just a symbolic badge—it's a cornerstone of their revenue growth. With NASA driving $1.1 billion in space exploration contracts, the partnership is pioneering future possibilities. The Texas-based titan anticipates $15.5 billion in 2025 revenue, predominantly sourced from its satellite business, Starlink.

The real revenue powerhouse? Starlink, SpaceX's satellite internet constellation. It's anticipated to pull in a mind-blowing $12.3 billion, serving clients like United Airlines, Deere, and the U.S. government. Starlink isn't merely connecting isolated areas; it's weaving an unbreakable web of high-speed internet across the globe, transforming lives and creating new markets. This stellar performance puts SpaceX at the forefront of technology disruption, proving that when you dare mighty things, the universe isn't the limit—it's just the beginning.

OpenAI: A Rising Star in the Unicorn Firmament

The digital pages of the tech world are buzzing, and right at the center of this cosmic swirl is OpenAI. OpenAI has captivated investors and tech enthusiasts alike, skyrocketing to a valuation of $300 billion, a meteoric rise fueled by the generative AI revolution. Since 2023, OpenAI's valuation has surged more than tenfold, powered by an impressive global user base of 700 million weekly active users.

Such figures aren't just numbers; they're a testament to the company's broad influence and the vast reach of its innovative AI-driven services. In the competitive arena of unicorns, where giants like ByteDance and SpaceX dominate the landscape, OpenAI's ascent is a narrative of technological triumph. From enhancing productivity with intelligent tools to reshaping entertainment and business models, OpenAI is not just keeping pace with tech juggernauts—it's rewriting the playbook.

ByteDance: The Social Media Behemoth

In the dynamic realm of groundbreaking technology companies, ByteDance stands tall as an internet behemoth. As the proud parent of TikTok, this Chinese giant has not just danced its way into the hearts of global users, but also into the wallets of sharp investors. With a formidable $220 billion valuation, ByteDance positions itself among the top-tier tech titans on the global stage.

The enthusiasm around ByteDance isn't just about big numbers on paper. The company boasts an almost jaw-dropping statistic: nearly two billion users worldwide. That's one in four humans on the planet consuming its content! Such widespread adoption isn't merely serendipitous; it's a calculated ascent powered by innovative content algorithms and addictive user interfaces, ensuring user engagement reaches unprecedented heights.

In 2025, ByteDance has its sights set on an ambitious financial target—anticipating revenue to leap by 20% to a staggering $186 billion. When placed alongside giants like Meta, which projects $187 billion in revenue, it's clear that ByteDance is playing in the big leagues and is not just a flash-in-the-pan sensation.

Global Investment Trends and Market Dynamics

These valuations are not just numbers; they are the whispers of tomorrow, informing investors where to place their bets in an ever-evolving global playing field. Nations like India and the UK have entered the arena, contributing unicorns with astronomically high valuations, marking this as a truly global phenomenon extending well beyond traditional powerhouses.

Beyond mere figures, companies like these illustrate the fierce return of investment energy surging through private companies, reigniting a fire in venture capital that had dimmed post-2021. AI-driven innovation is at the helm, steering this ship into waters rich with opportunity and growth. For investors keen on harnessing these stellar trajectories, the swelling investments in AI-centered ventures spotlight a new era of innovation and value creation.